China’s Programmatic Media Buying: Market Trends and Forecast

Core Point of View

New Understanding on Programmatic Buying

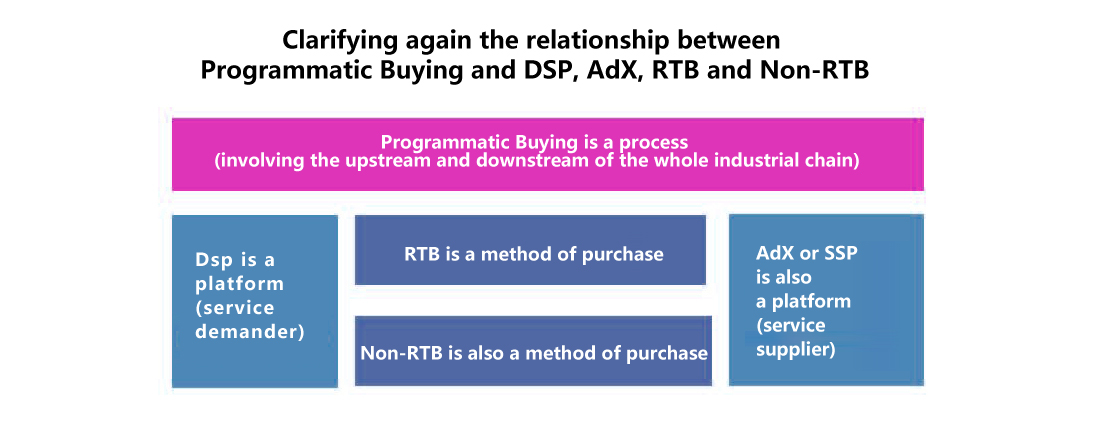

The period of low awareness has passed and now the market has a deeper understanding on Programmatic Buying.

Programmatic Buying refers to the trading and delivery of advertisements based on technology and data. Compared to the early purchase by pure manpower, the digital, automated and systematic approach can greatly improve the efficiency of advertising transactions, expand the transaction scale and optimize the effectiveness of advertising. 1) For the advertisers, through Programmatic Buying on media resources, they can accurately reach the target audience, tracking users and achieve multiple exposures. 2) For the media, on one hand, they can improve the fill rate of long-tail flow. On the other hand, they can price the same advertising bit differently according to different time and regions and sell to different advertisers.

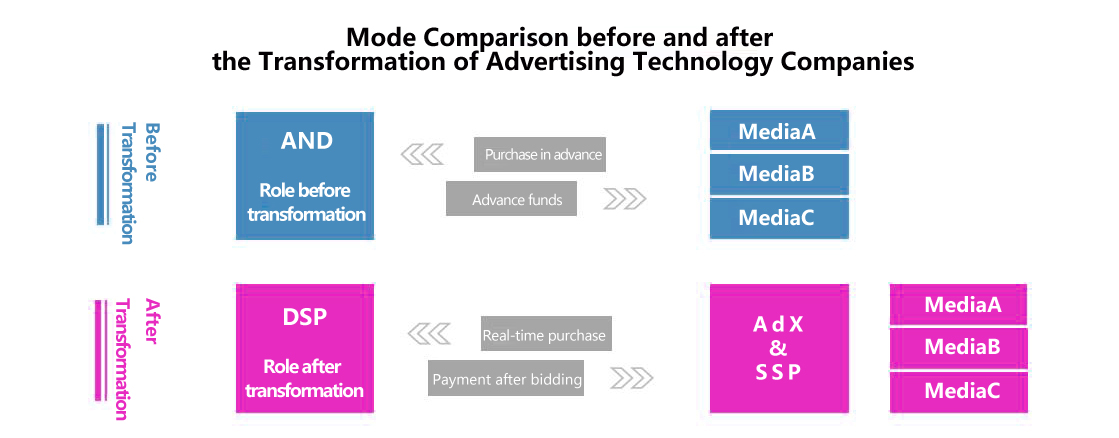

In the early days, since the market had low awareness of Programmatic Buying, people mistakenly think that Programmatic Buying is DSP, or that Programmatic Buying is RTB. And now, after five years of development, the market has a more clearly and in-depth understanding of Programmatic Buying as well as its relationship with DSP, AdX, RTB and Non-RTB.

Development Background of Programmatic Buying

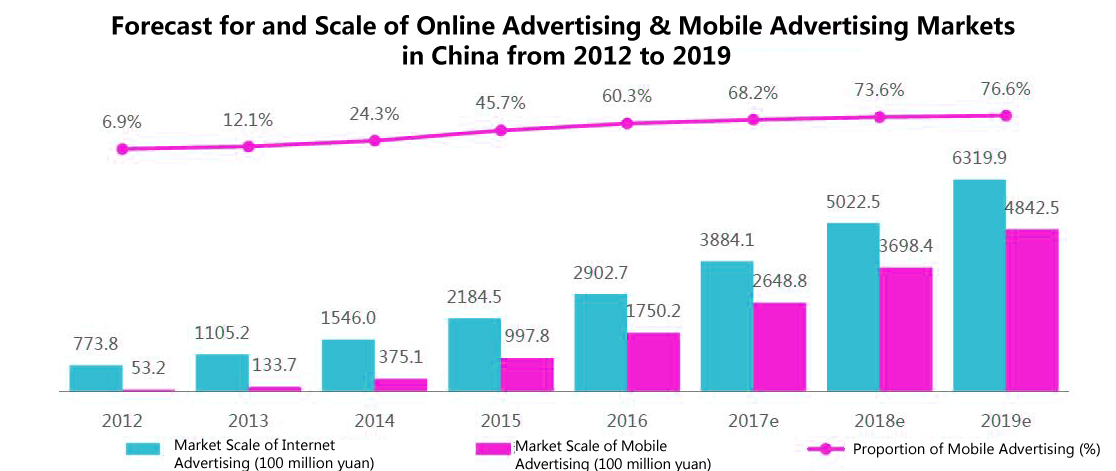

The scale of online advertising keeps growing and the industrial chain becomes more and more perfect.

Programmatic Buying could not develop without the development of the entire online advertising industry. In 2016, the scale of online advertising in China was 290.27 billion, of which the scale of mobile online advertising reached to 175.02 billion, accounting for 60.3%. The rapid growth of the number of Internet users and the used hours on the Internet by users, the continuous improvement of the online advertising industrial chain and the increasing maturity of advertisers, agents and media led to the rapid growth of the overall scale of online advertising, which all together made up the background of and established a good foundation for the development of Programmatic Buying.

After 5-year practice, Programmatic Buying enters the adjustment period.

Programmatic Buying has experienced the four key development nodes, embracing a huge room for growth in the future.

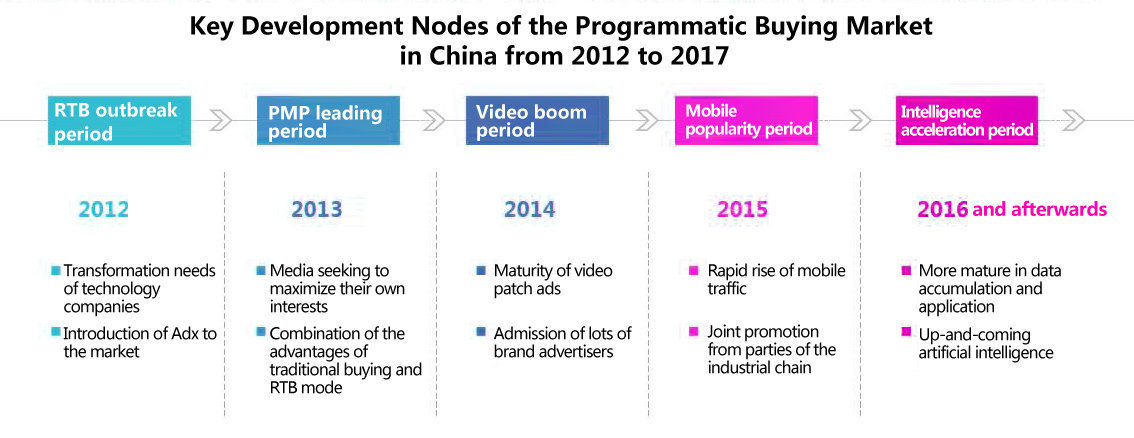

From the first year of Programmatic Buying in 2012, it has 5 years since its practice in China.Among these years, Programmatic Buying received a warm pursuit by capitals with hundreds of Programmatic Buying platforms sprang up, and has experienced the four key development nodes including the RTB outbreak period, PMP leading period, video boom period and the mobile popularity period. With these five-years development of Programmatic Buying, the important role of technology and data in advertising has been brought into play and the efficiency and effectiveness of online advertising has been effectively enhanced.

In 2016, due to the accumulation and outbreak of traffic cheating, advertising opacity and other historical problems, there were issues occurred in the Programmatic Buying market like the increased distrust from advertisers and the decline of market growth rate, which led to the introspection of the whole industrial chain, and the Programmatic Buy market entered into the adjustment period. However, IResearch believes that the adjustment period will be short and the technical- and data-driven digital marketing trend is unstoppable. With the application of artificial intelligence, block chain and other technologies, Programmatic Buying will enter the accelerated development period of intelligence.

RTB Outbreak Period

The transformation needs of advertising technology companies became the first driving force.

In the Ad Network era, advertising technology companies need to purchase a great number of media resources in advance to meet the advertising demands. In its late period of development, due to the large number of market entrants, their competition focused completely on resources, which increased the capital pressure and the plight of survival faced by advertising technology companies. Consequently, they showed appreciation for the Real Time Bidding (RTB) mode. Under the RTB mode, the advertising technology companies could apply the real-time and biddable purchase method instead of buying media resources in advance, which solved the efficiency issue in the sale of resources under the advertising network mode and also reduced the original financial pressure. As a result, driven by the transformation needs, the advertising technology companies began to vigorously promote the domestic development of RTB.

RTB Outbreak Period

The introduction of Ad Exchange, a media icon, became the development catalyst.

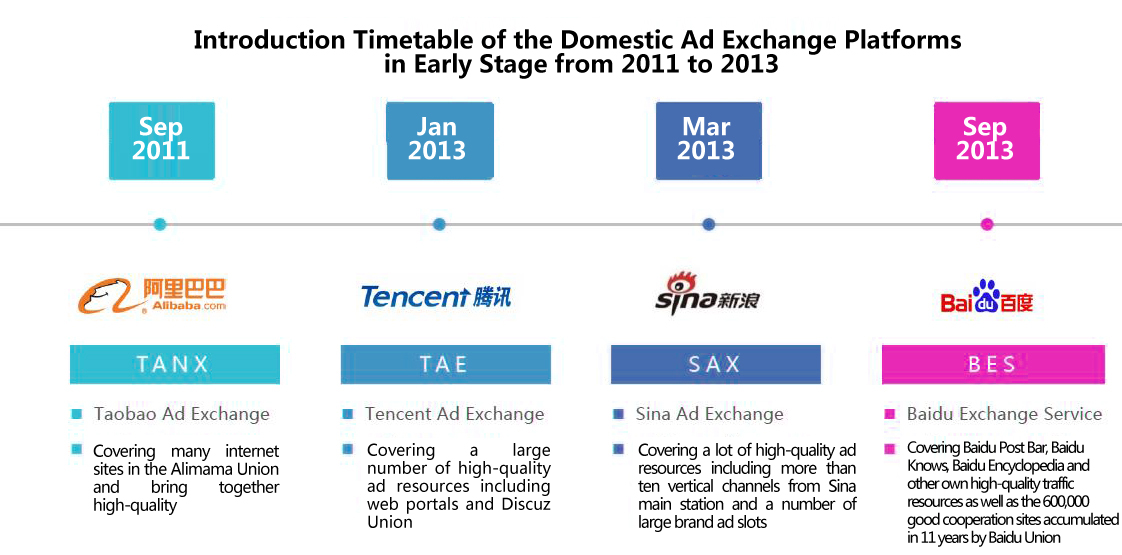

Since the introduction of AdX (Ad Exchange, an advertising platform) by Google in June 2011, Alibaba, Tencent, Sina, Baidu and other domestic Internet icon companies intensively introduced their own Ad Exchange platforms, which on one hand, provided plentiful high-quality biddable resources, and on the other hand, had a relatively rich and complete functional modules and connected with a number of third-party DSPs in the market, fast upgrading the hotness of the RTB market.

PMP Leading Period

The media to maximize their own interests and to control the process of advertising transactions

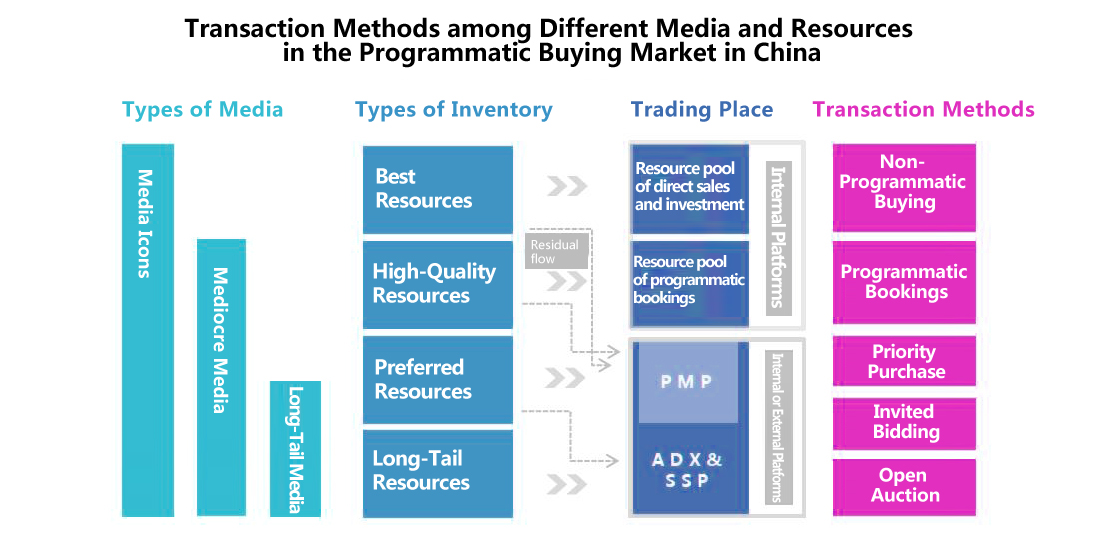

Although the RTB market has been driven to emerge by multiple forces, but the uncertainty of advertisers' quality and advertising prices in the RTB model has reduced the willingness of the media to promote this model. In most cases, the media would cash the long tail traffic that is hard to be sold directly in the open market and sell the high-quality resources through the traditional direct customer channels. At the same time, when participating in the RTB market, the media has also recognized the value of Programmatic Buying, which caused the media to begin to promote PMP (Private Marketplace) in the case of maximizing their own interests. PMP combines the advantages of traditional advertising purchase and Programmatic Buying, which ensures the relative certainty of advertisers and advertising resources and also improves the efficiency through the programmatic means and optimizes the advertising effect.

Video Boom Period

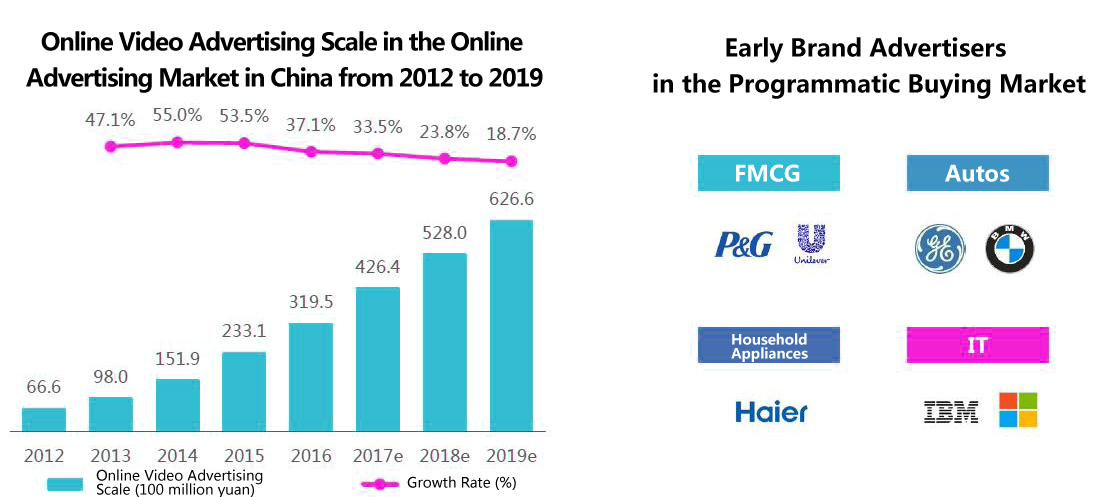

Increased growth of the overall scale of video advertising and the demonstration effect of brand advertisers

From 2013 to 2014, the overall scale of video advertising began to grow rapidly meeting the advertising needs and inertia of brand advertisers. Meanwhile, the non-public bidding programmatic advertising process became increasingly mature and ensured that the quality and purchase prices of media resources met the advertisers' requirements. P&G, Unilever and other large brand advertisers began to budget for the video programming, which played a demonstration effect, and more brand advertisers increased their budget for video programmatic buying. Early video programming mainly focused on the pre-roll ads on video sites, and with the enrichment of video contents and advertising resources, video programming was gradually applied to the information flow advertising, Product Placement and Launch Screen as well as extended from the PC end to mobile end.

Mobile Popularity Period

Rapid growth in traffic is the main driving force and the one-year development of the mobile end is equal to the four-year journey of the PC end.

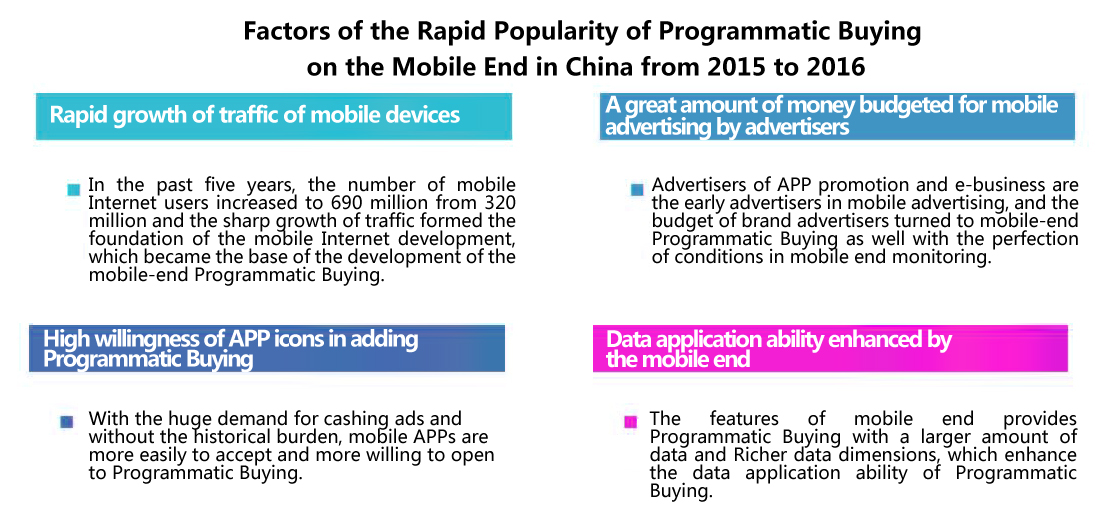

From 2015 to 2016, the main driving force for Programmatic Buying was the mobile end. On the basis of the practice and experience of the PC-end Programmatic Buying, the mobile-end Programmatic Buying finished the four-year journey of the PC end in one year's time. In the period ahead, mobile Programmatic Buying will still be the core force promoting the development of the entire Programmatic Buying Market. IResearch believes that the popularity of mobile Programmatic Buying in the past was jointly promoted by multiple factors including the rapid growth of traffic of the mobile end, budget restructuring of advertisers, Hero App's strong demand for cashing and the upgrading of data application ability.

Intelligence Acceleration Period

The curtain has been opened, but it needs more time for the future to come.

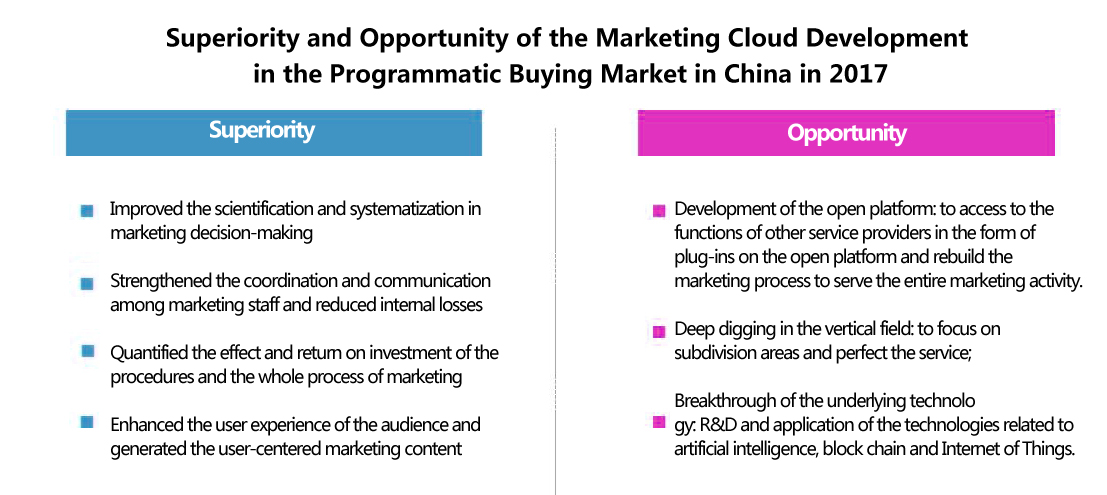

The application of Programmatic Buying in digital marketing is always based on the improvement of efficiency, and the application of artificial intelligence technology in marketing will accelerate this process. The core of intelligent marketing is to predict people's behavior, which is difficult to achieve through the traditional simple and scattered marketing activities, and therefore, relies on the underlyng support of the marketing cloud and the connection of data. In the United States, IT giants like Adobe, Oracle and IBM entered into the digital marketing market through the marketing cloud and received a large amount of money from advertisers. In domestic, 1) software companies, marketing agents and advertising monitoring companies are trying to build their own marketing clouds and moved the traditional business to the cloud, in order to seize the initiative. 2) Emerging start-up companies are also seeking the opportunity of single-point breakthrough to become a catfish in the market. However, due to the commercial barriers between enterprises, domestic marketing APIs are in shortage, which has hindered the flow of marketing data as well as the full realization of intelligent marketing. The curtain has been opened, but it needs more time for the future to come.

The Regulated Programmatic Buying for the first time

The parties' obligations were definite and the development of the Programmatic Buying market would be standardized.

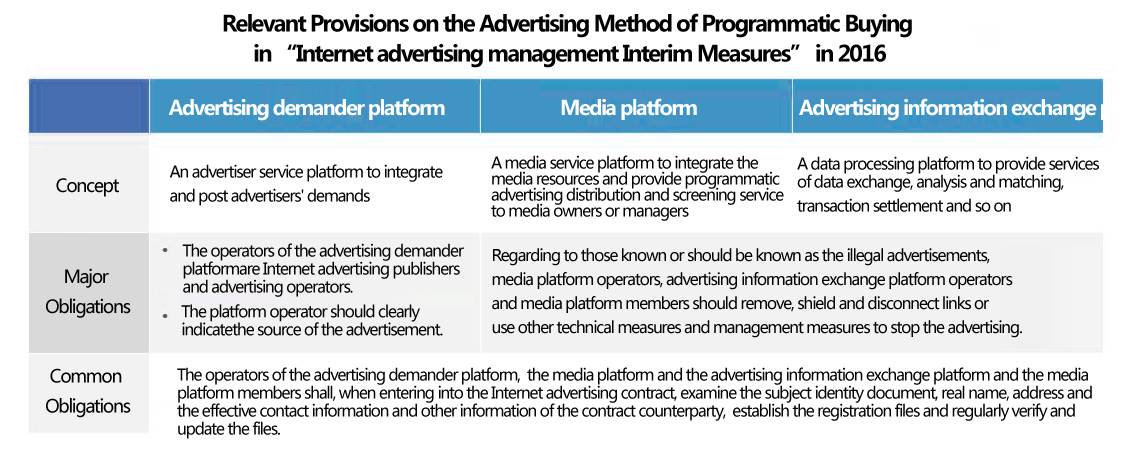

On September 1, 2016, the "Internet advertising management Interim Measures" published by the State Administration for Industry and Commerce was formally implemented. In the above Interim Measures, Programmatic Buying was included in the regulation for the first time. Term No. 13, No. 14 and No. 15 in the Measures recognized the Programmatic Buying method and made a description on the concept and obligation of the major roles in Programmatic Buying and the industry chain like the advertising demander platform, media platform and the advertising information exchange platform. IResearch believes that these provisions in essence established the standards and conditions for the participants to access to and participate in the Programmatic Buying market. With the supervision on the main body of the participants, the existing issue of unclear rights and responsibilities in the market is to be solved and the development of Programmatic Buying will be gradually standardized.

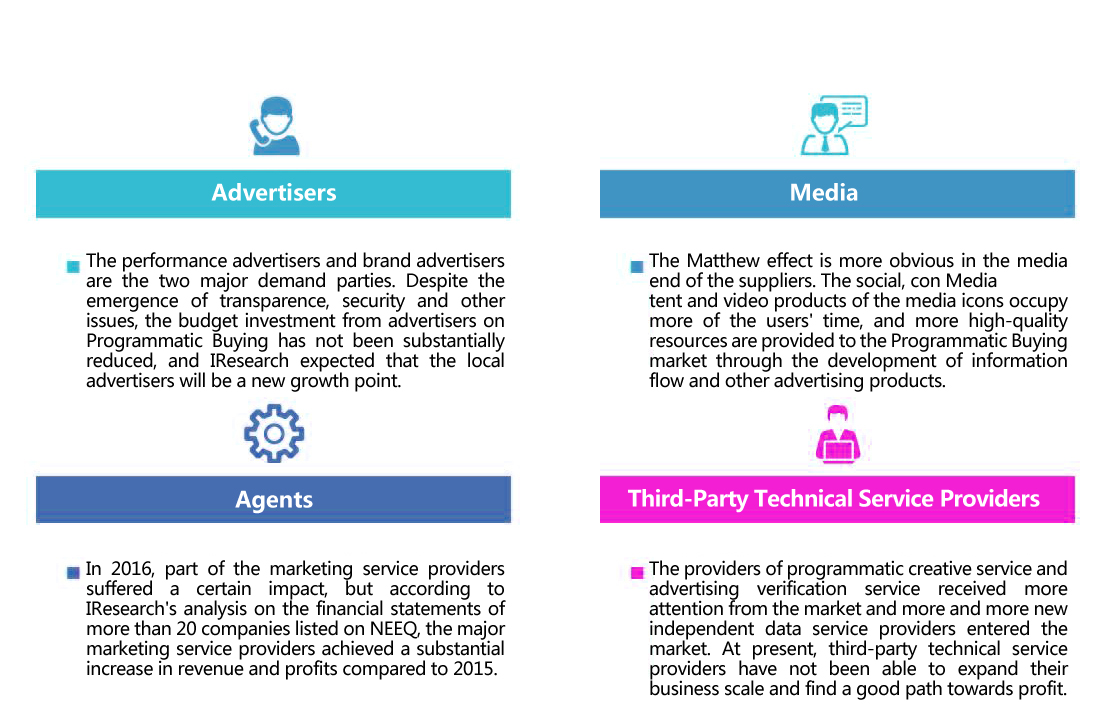

Programmatic Advertising Platform built by Media

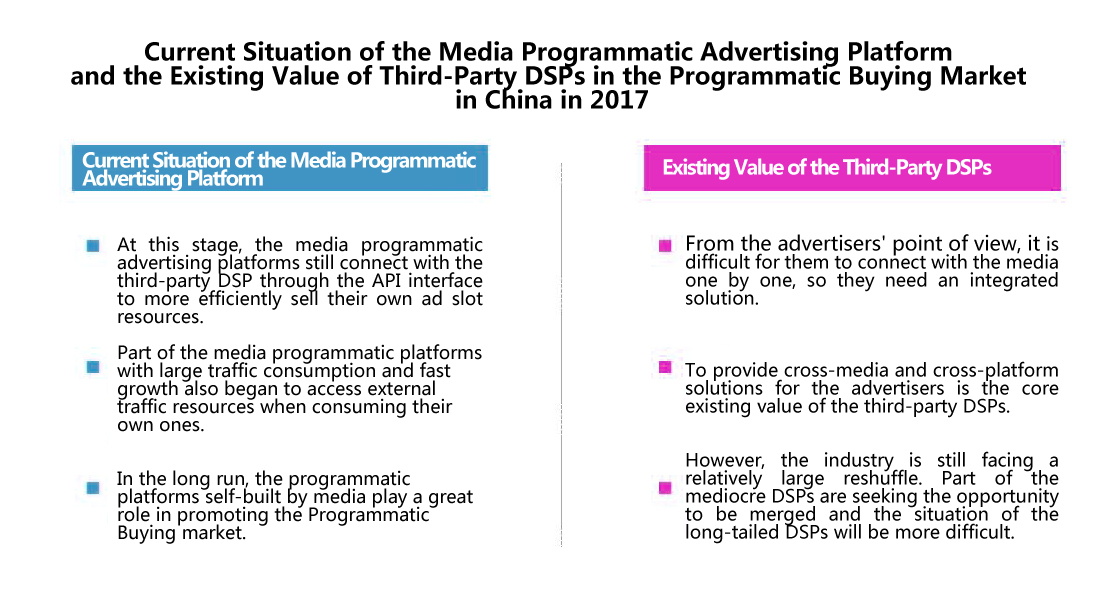

The self-built Programmatic Advertising platform by media can promote the overall market and the third-party DSPs still have its unique value.

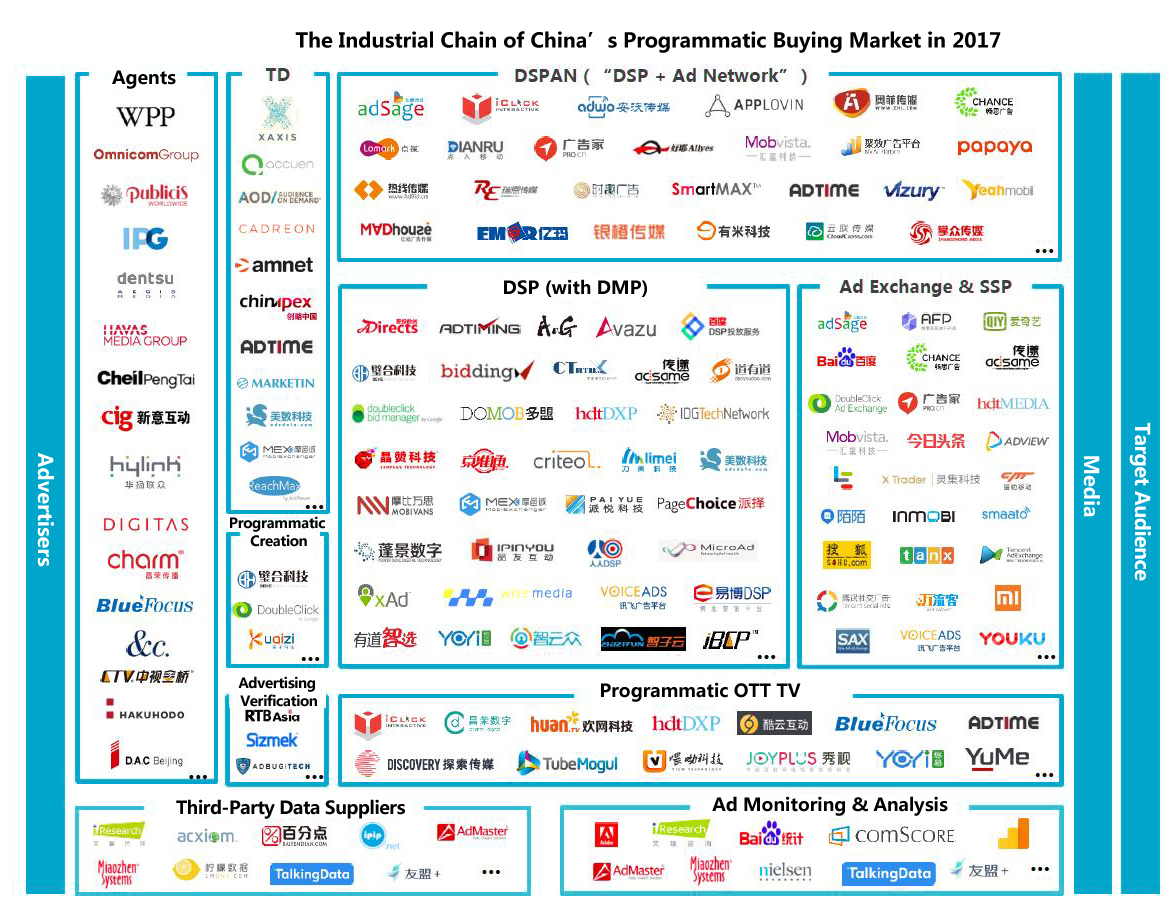

In the industrial chain of Programmatic Buying, the media, as suppliers, possessed both the traffic and customer resources when reaching a certain amount of volume after development and began to build their own programmatic advertising platforms, including the early Baidu, Ali, Tencent, Sina, Sohu, Netease (Youdao), Ifeng, 360 and other information service providers as well as Jingdong, Meituan and Dianping and other trading platforms. IResearch believes that the main forces driving media to build their own programmatic advertising platforms were: 1) to obtain more right to speak in the industrial chain, which can get more dividends in the value chain and enhance the overall level of profit; 2) to ensure data security, improve their own DMP and enhance the data application capabilities.

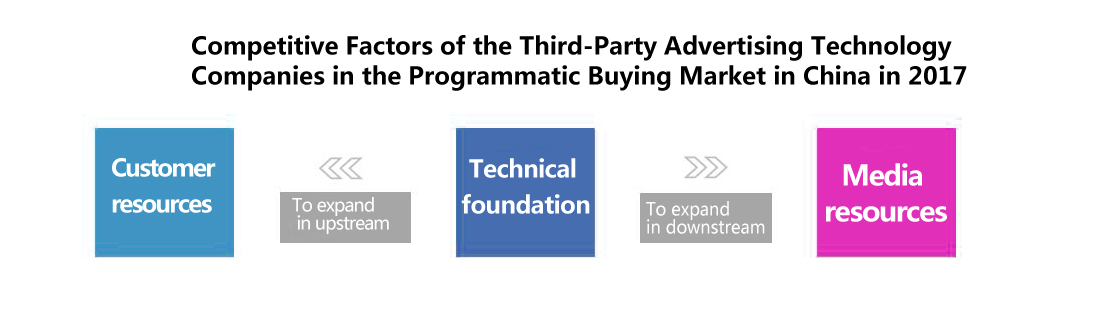

Third-Party Advertising Technology Companies' Way Out

Technology is the foundation, while customer and media resources are still the key to competition.

In the development of China's Programmatic Buying market, the third-party advertising technology companies have been an important participant in the industrial chain. After years of development, the market competition situation for these companies has been relatively clear: 1) in the early development of the market, the third-party advertising technology companies were deeply sought after by the capital and focused on the market share and turnover, and in pace with the overall cooling of the market hotness, those companies were currently in fine operations and paid attention to profits; 2) in the above process, part of the third-party advertising technology companies have been merged by media Giants or large-scale communication agency groups, while the other part of the companies chose to be listed in NEEQ to lay the foundation for more capital opportunities for the future; 3) over the past year, when the media were vigorously building their programmatic advertising platforms and the third-party programmatic advertising platform adjusted their own development, the third-party advertising technology companies' way out attracted more attention.

Technology is undoubtedly the foundation of the third-party advertising technology companies in the market, and they have been stressed their own technical strength too. However, in the current online advertising environment, technology is difficult to be a decisive factor of winning in the competition, because on one hand, both ends of supply and demand, media and advertisers, still hold a huge right to speak while the third-party advertising technology companies are weak, on the other hand, technology can only play its value when applied to the specific business cases and the accumulation of data also needs a lot of business support. Thus, while continuously improving the technical strength, to expand customer resources, especially customer resources in the subdivided industries, and enlarge media resources is still the key for the third-party advertising technology companies to maintain their competitiveness.

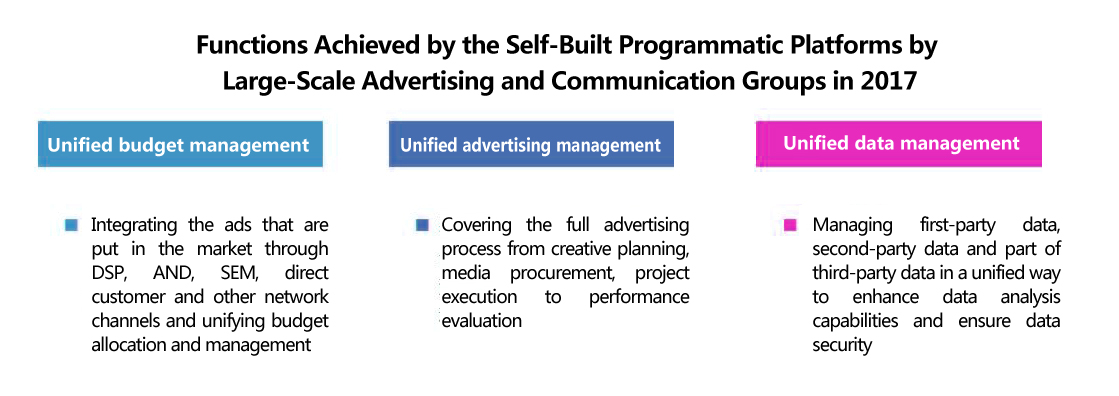

Programmatic platform self-built by large-scale communication group

The progress is slow and subjects to the domestic advertisers, media environment and other factors.

That 4A and local large-scale advertising and communication groups self-built programmatic advertising platforms was divided into three directions: 1) TD (Trading Desk) - currently the products and system structures of most of TDs in the market were completed by external technical teams, and 4A companies hope to build and continuously optimize the TDs to meet their order demands in programming, or even gradually reduce the dependence on other programmatic platforms; 2) SSP - 4A companies have a lot of traffic resources, in addition to meet their own demand for advertising, they also want to cash the remaining traffic; 3) DMP - for now they mainly help customers find suppliers or build DMPs, and self-built DMP is not perfect yet.

4A and local large-scale advertising and communication groups hope to achieve unified budget management, advertising management and data management through self-built programmatic advertising platforms. However, although some 4A companies have relatively mature technology and service experience in foreign countries, currently the application progress of the domestic Trading Desks is still slow, which is constrained by a variety of factors including the low degree of awareness of advertisers, the great right to speak of the domestic media and the poor willingness for data openness.

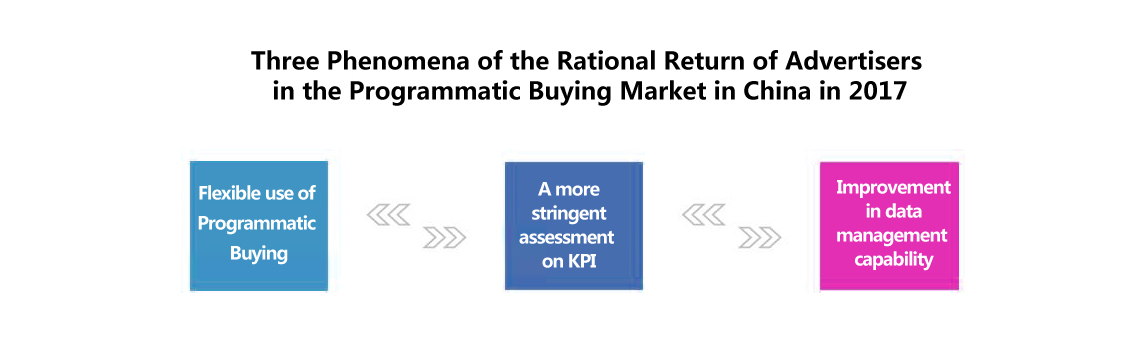

The Rational Return of Advertisers

KPI assessment became more stringent, and the data management capability has been continuously improved.

In the early stages, those who chose programmatic advertising were mainly advertisers in pursuit of advertising performance, simply seeking to the downloads and converting of ads. Many of them blindly followed the trend and chose programmatic advertising in the absence of in-depth understanding, just because the hotness in Programmatic Buying. They expected too much of the precision that is different from the actual implementation and feedback, which caused their doubts and hesitation against programmatic advertising.

At present, after the market practice and education, advertisers began to return to rationality: 1) regarding programmatic advertising as daily advertising and making flexible use of a variety of purchase methods according to the needs, for example, purchasing priority traffic through PDB to ensure scheduling and using RTB for timely replenishment when the limited order traffic cannot meet the advertising of KPI; 2) advertisers have a more stringent assessment on KPI, in which an incremental change has taken place, from simply assessing the advertisement exposure to assessing the reach of target audience and the increase of TA concentration and then assessing the proportion of N + Reach; 3) although advertisers paid more attention to their own data management capability, currently they still only possess the primary monitoring capability and simple monitoring means, which means that to enhance the data management capability is the future direction of the development of advertisers.

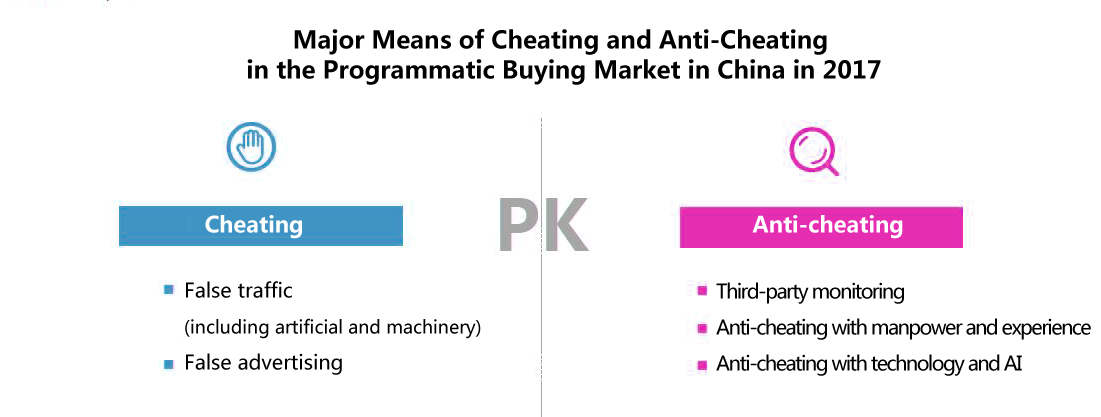

Anti-Cheating

Anti-cheating is the common obligation of the whole industrial chain and is always a dynamic gaming.

The existence of cheating has led to the waste of the advertisers' budget and the deepening of the degree of distrust of the advertisers against Programmatic Buying, which has brought serious negative effects to the entire industrial chain. Therefore, anti-cheating should be an indispensable part of the process of programmatic advertising. Anti-cheating is based on data, and the longer the advertisement is put in the market, the more data will be accumulated, which means easier in selecting the good traffic in the complex traffic environment and higher success rate to catch cheating. However, it is difficult to completely eliminate cheating. Cheating and anti-cheating will always be in the dynamic gaming.

Anti-cheating is the common obligation of the whole industrial chain. In the industrial chain of Programmatic Buying, every party can become a victim of cheating. Anti-cheating depends on the joint efforts of the upstream and downstream of the industrial chain, which means that the advertisers, DSP, Ad Exchange , SSP and the media need to consider from the long-term interests, establish cooperative relations for anti-cheating standards and means and jointly promote the substantive implementation of anti-cheating.

Brand Safety

Problems are solved mainly from the media and content level.

Brand safety refers to that the brand's ads appear in the inappropriate media or content, causing consumers to feel discomfort, disgust and other negative emotions, thus affecting the consumer's perception and attitude towards the brand, and ultimately hurt the brand image. In the process of Programmatic Buying, especially in RTB mode, due to the characteristics of the audience's purchase, it is difficult for advertisers to decide the media and content of their ads and thus brand security is facing more prominent problems. In order to solve the problems of brand safety faced by advertisers, professional advertising verification service providers have emerged. At the same time, advertising technology companies have invested more energy in brand safety protection. Brand safety protection also depends on the deep cooperation with the media.

The Transparency of the Digital Advertising Supply Chain

Advertisers did not only pursue the results, but also concerned more about the process.

All along, in the process of Programmatic Buying, the marketing service provider was responsible for the advertising process and the advertisers determined whether to complete the advertising of KPI based on the monitoring results and concerned less about the process of advertising. With the outbreak of traffic cheating and false trading and other negative problems, advertisers paid more attention to the advertising process and the transparency issue of the digital advertising supply chain was highlighted. Transparency in the digital advertising supply chain should include at least four dimensions: traffic transparency, advertising transparency, settlement transparency and data transparency.

To solve the transparency problem of the digital advertising supply chain, it needs the joint efforts from the advertisers, marketing service providers and the media: 1) for advertisers, they need to continuously upgrade their understanding on technology and Programmatic Buying and be more rational in developing the advertising strategy and the assessment on KPI; 2) for marketing service providers, they need to provide a sound system and detailed statements for advertisers, at the same time introducing an independent third party to monitor; 3) for the media, they need to further open their own data black box, accept the review from third-party agencies and measure the ad performance with a unified standard.

Expectations to Data Opening

Technology is not the difficulty, but to find the balance of interests is the key.

Since the advent of Programmatic Buying, data has been the cornerstone of its development. Over the past few years, the entire industry has been driven by new traffics and achieved a relatively extensive growth. Data is not a constraint on the development of the market, but with the Internet joining the second half, there was no more traffic dividends and Programmatic Buying got higher requirement, greater demand and more reliance on data. Thus, the standardization and liquidity issue of data was highlighted.

Although the third-party agents and advertisers are building their DMPs, the market generally expects more of the data opening of the media because of its larger media volumes, richer dimensions and smaller granularity. At present, what the media do is mainly to return data results based on the data requirements from advertisers and third-party agencies. IResearch believes that in the short term, substantive action is still difficult to be implemented in data opening. Technology is not the difficulty, but to find the balance of interests among the parties is the key to change the status quo.

Overview of the Industrial Chain

Programmatic Buying Market still in the Early Stage of Development

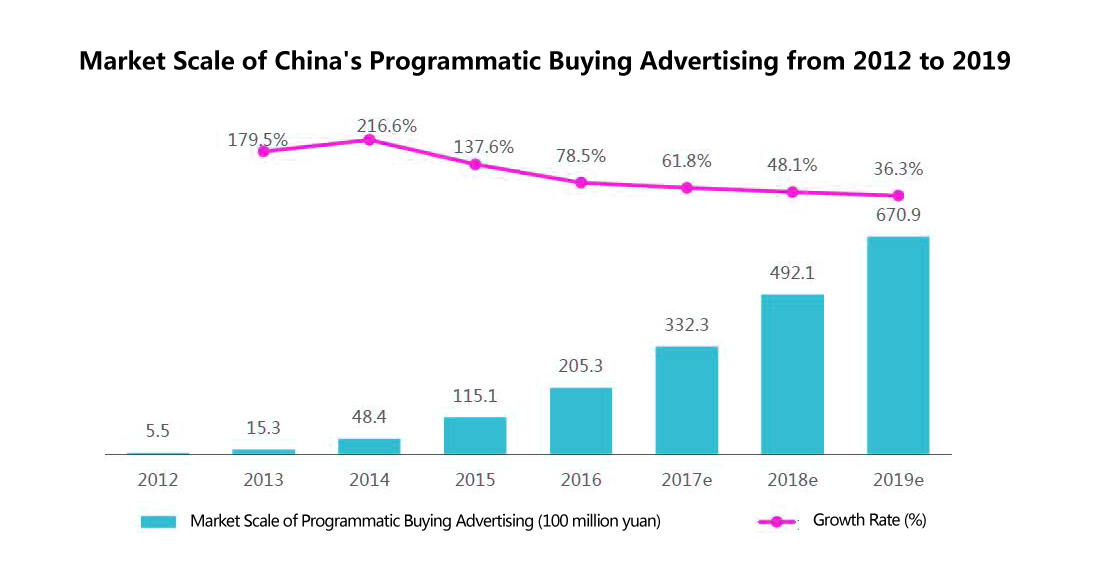

In 2016, the market scale was 20.53 billion, an increase of 78.5% over 2015.

In 2016, the market scale of China's Programmatic Buying advertising was 20.53 billion, an increase of 78.5% over 2015, which is expected to reach 67.09 billion in 2019. IResearch believed that Programmatic Buying had maintained a growth rate of more than 100% year after year since 2012 and entered into the adjustment period in 2016 with an overall slowdown in growth. In the long run, China's Programmatic Buying market is still in the early stage of development and has a larger room for growth in the future, but its growth model will change from the past high-speed burst growth to medium- and high-speed steady growth.

Mobile Programmatic Buying Maintaining High Growth

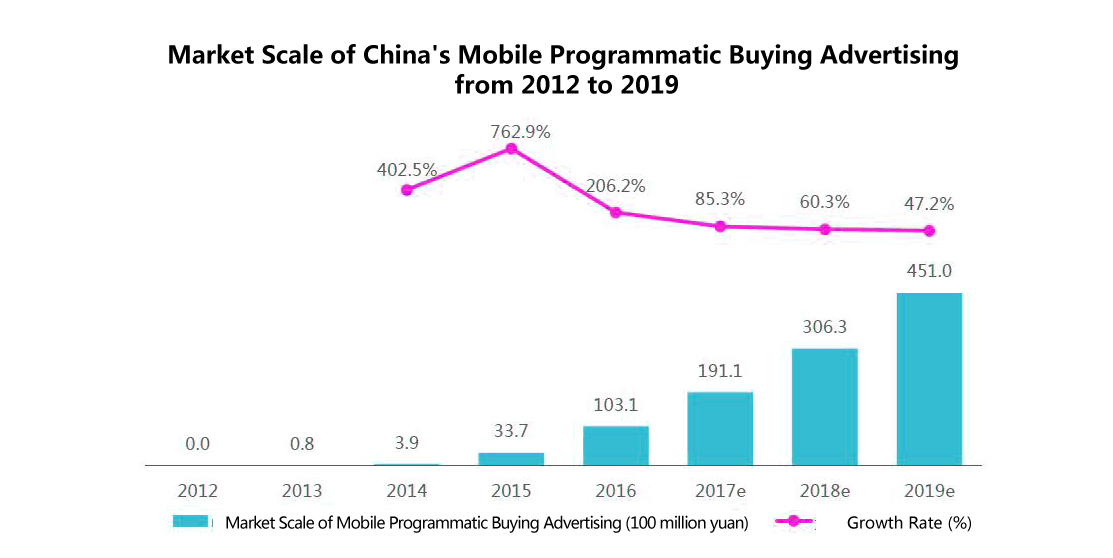

In 2016, the market scale was 10.31 billion, an increase of 206.2% over 2015.

In 2016, the market size of China's mobile Programmatic Buying advertising was 10.31 billion, an increase of 206.2% over 2015, which is expected to reach 45.1 billion in 2019. IResearch believes that mobile Programmatic Buying has been the main driving force of the market growth of Programmatic Buying since 2015, and in the next three years, mobile Programmatic Buying will continue to grow at relatively high speed, of which the growth rate will be significantly higher than that of the overall market.

Share of Mobile End over PC End for the First Time

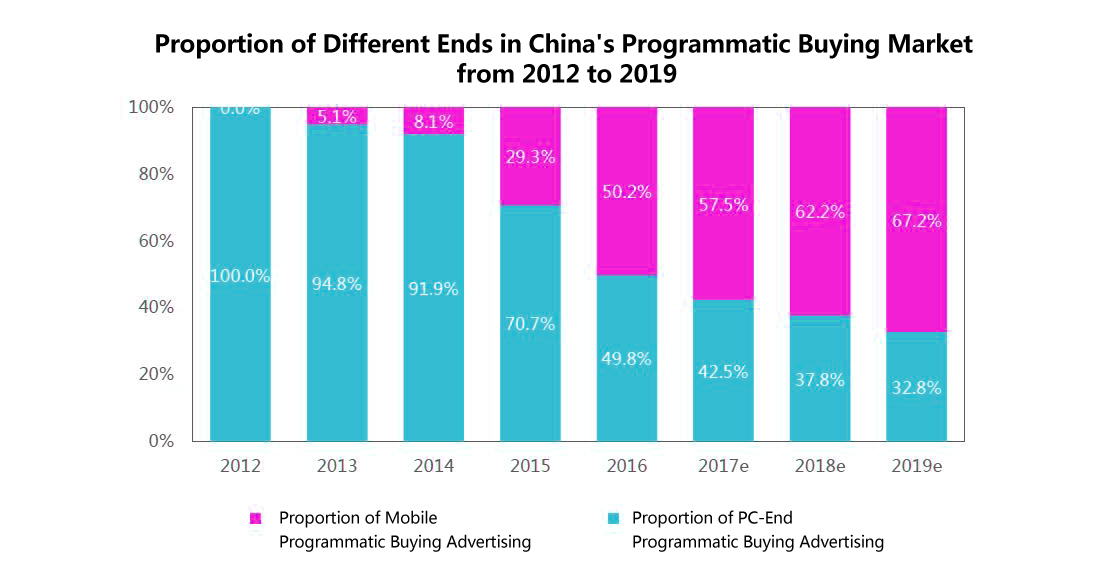

In 2016, the mobile end accounted for 50.2%, which is expected to be more than 65% in 2019.

In 2016, the scale of the mobile online advertising market for the first time exceeded the overall size of the PC-end online advertising market and the traffic of mobile Programmatic Buying grew rapidly. The advertisers' budget for Programmatic Buying was also tilted to the mobile end on a large scale. The market size of mobile Programmatic Buying accounted for 50.2%, exceeding the expected growth and that of the PC end historically. IResearch believes that the proportion of the mobile end will continue to expand and will exceed 65% by 2019.

The Increasing Share of Non-RTB

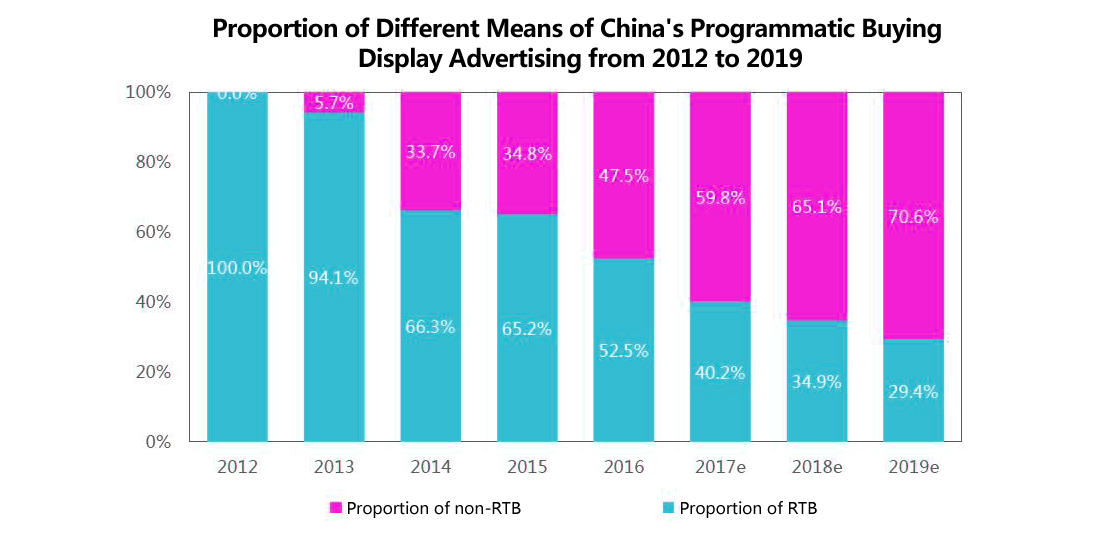

In 2016, non-RTB accounted for 47.5% and is expected to be more than 70% by 2019.

Since 2013, the means of non-RTB transaction rose and quickly became an important driving force for the overall development of the Programmatic Buying market. In 2016, non-RTB accounted for 47.5% and the gap between non-RTB and RTB significantly narrowed. IResearch expected that the proportion of operation scale of non-RTB will be higher than that of RTB in 2017 for the first time, accounting for 59.8% and 70.6% by 2019.

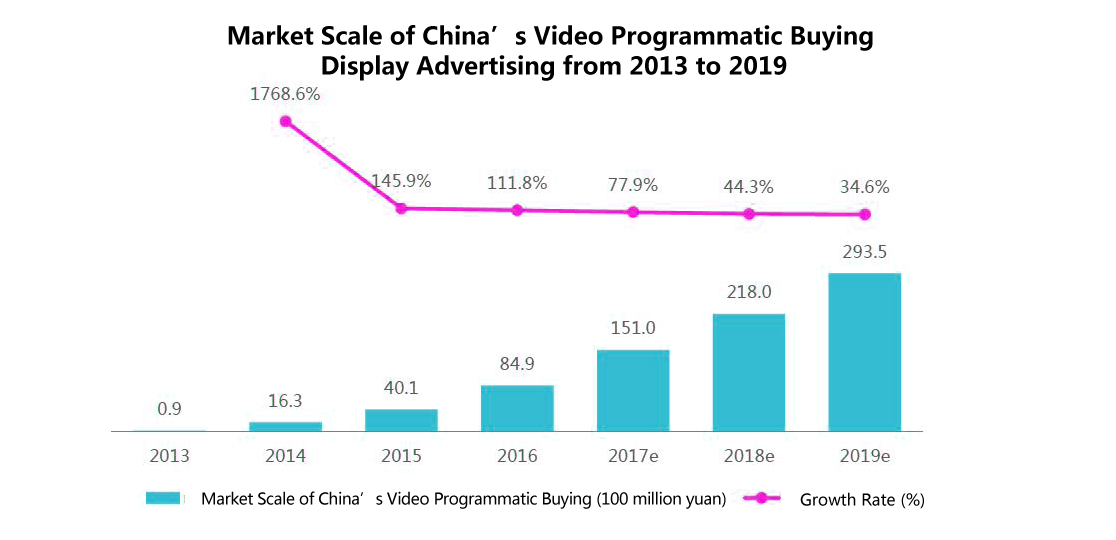

Video Programming as a Driving Force for Growth

In 2016, the market scale was 8.49 billion, an increase of 111.8% over 2015.

With the rapid growth in demand for video advertising from the advertisers, especially brand advertisers, and the opening of a large number of mobile video advertising resources, the market size of video programmatic buying advertising grew rapidly, reaching 8.49 billion in 2016, an increase of 111.8% over 2015. In the next three years, it will continue to maintain rapid growth and is expected to reach 29.35 billion by 2019.

Growth Motivations for the Development of Programmatic Buying

Automation will continuously replace the manual operation in various aspects.

The driving forces for the development of Programmatic Buying market in the future come from both inside and outside: 1) The internal motivation is that the industry standards and norms of the Programmatic Buying market are further refined and improved, the data market is open and data flow is accelerated and the technology of Programmatic buying advances, especially the application of new technologies such as artificial intelligence and block chains. 2) The external motivation is the promotion of the participation of the media and the advertisers in Programmatic Buying, the increased traffic quantity and improved traffic quality with media as the suppliers and the increased budget for Programmatic Buying with advertisers as the demanders. IResearch believes that the ultimate goal of the development of Programmatic Buying is to continuously replace manual operation with automation in all aspects. The development of Programmatic Buying is endless and will not stop.

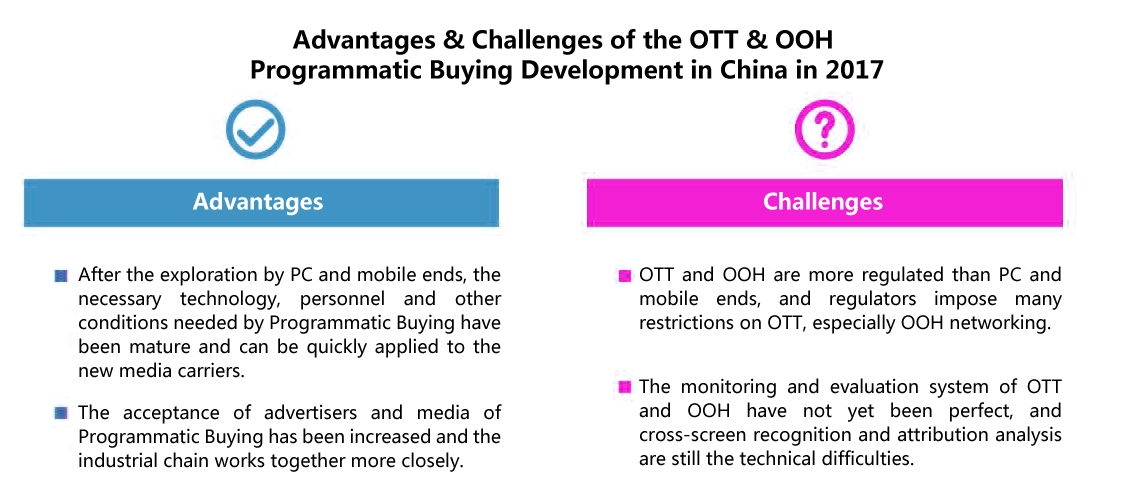

Trend 1: The process of new media programming will be accelerated.

It is currently in the embryonic period with the development of technological superiority and regulatory challenges coexisting.

From a media perspective, after the penetration of Programmatic Buying into the PC end and the mobile end, the advertising technology companies in the industry has regarded OTT (OvertheTop) and OOH (OutofHomer) programming as a new growth point, however, OTT and OOH programming have advantages as well as big challenges. In contrast, the process of OTT programming is faster and has already implemented some practical cases. IResearch believes that new media carriers including OTT, OOH and VR to realize Programmatic Buying is a general direction, however, it is still in a very early stage and needs at least two to three years' time for OTT to be rewarded, while OOH needs at least three to five years and VR and other carriers five to ten years.

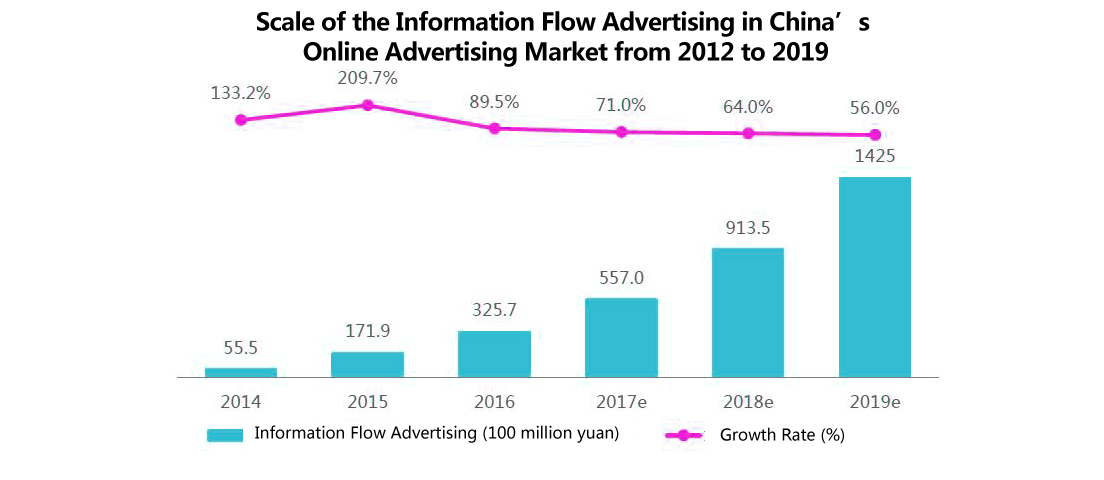

Trend 2: The process of native ad programming is accelerated.

Information flow advertising has a hidden risk of inventory resource depletion, thus more playing methods need to be found.

In the perspective of the advertising forms, after the graphic and video forms of advertising, the market generally concerned about the original advertising programmatic buying with the information flow as the representative. From a technical point of view, all display ads are suitable for programmatic advertising and traffic advertising is no exception. IResearch expected that in 2016 the scale of information flow advertising has reached 32.57 billion yuan and will maintain a growth of more than 50% in the next three years, which becomes the fundamental of the realization of Programmatic Buying in information flow advertising. However, because there is a threshold in the users' tolerance against the advertisement frequency in the information flow, there is a hidden risk of resource depletion in the development of information flow advertising. Therefore, the original advertising programmatic buying needs to explore more playing methods based on the original content in addition to information flow advertising.

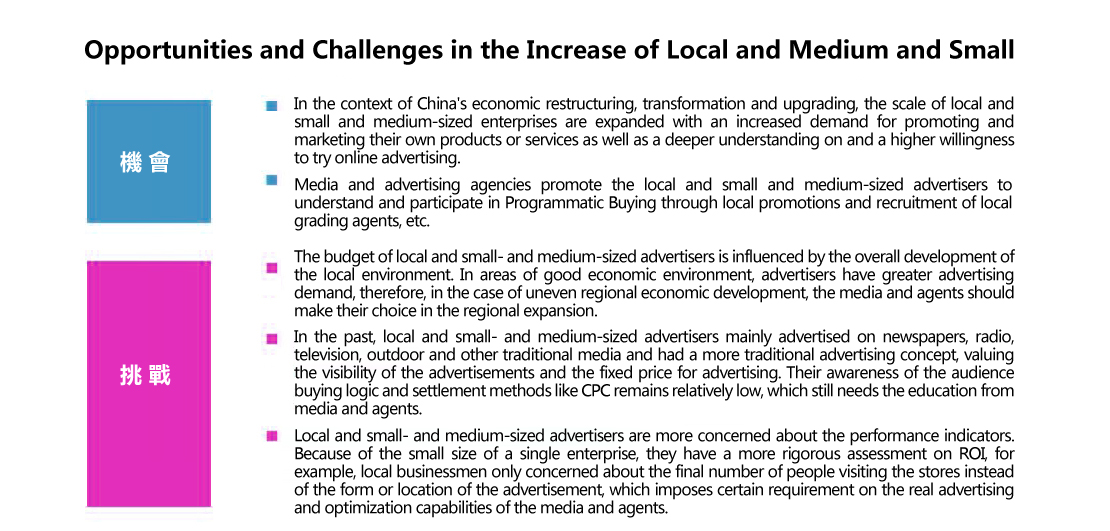

Trend 3: Local and medium and small advertisers become a new growth point.

It is affected by the level of regional economic development, the degree of awareness of advertisers and other factors.

At this stage, the representatives of advertisers of Programmatic Buying include advertisers of FMCG, automotive, finance, real estate and other brands and Internet advertisers of e-commerce, tools and games, mainly because these two types of advertisers spend long time and have rich experience in online advertising and are in high willingness and have great motivation to try new technology. IResearch believes that with the general decrease in Internet users and channels, local and medium and small advertisers will become a new growth point of demanders in the programmatic buying market and in the long term, this momentum will not stop. But in the short term, it still faces the challenges of multiple factors such as the imbalance of regional economic development and the low degree of awareness of advertisers.

Trend 4: Attribution analysis and evaluation system are set up.

It depends on the cross-channel, media, equipment and online and offline data support.

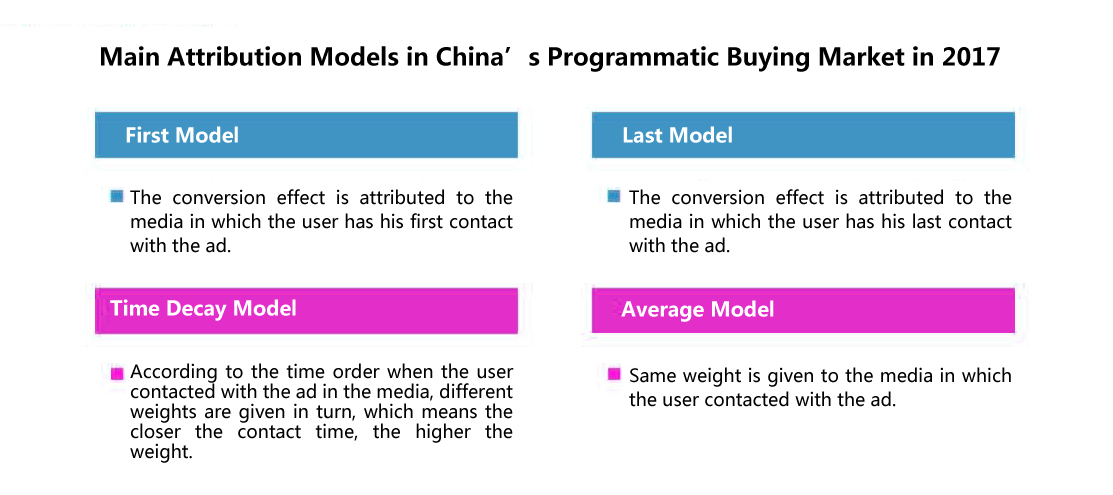

Attribution Analysis refers to the source trace of the marketing results to determine which time or which times of ad interaction has or have affected the users' last consumer behavior. Attribution Analysis helps advertisers measure the ad performance, analyze the contribution of different ads throughout the marketing campaign and adjust and optimize their advertising strategies in a timely manner. In an increasingly complex marketing environment, Attribution Analysis relies on cross-channel, cross-media, cross-device, cross-online-offline data support.

At present, the application of Attribution Analysis in the Chinese market is still very elementary. Attribution Analysis is essentially the issue of how to assess digital advertising. With the attention of advertisers to the evaluation of advertising and Attribution Analysis, the upstream and downstream of the marketing industrial chain will put more energy in the construction of the attribution analysis and evaluation system, and the Internet giants with full account system will play an important role in this.

Trend 5: Marketing cloud comes true.

Ad-Tech migrates to Mar-Tech, covering the full cycle of marketing campaigns.

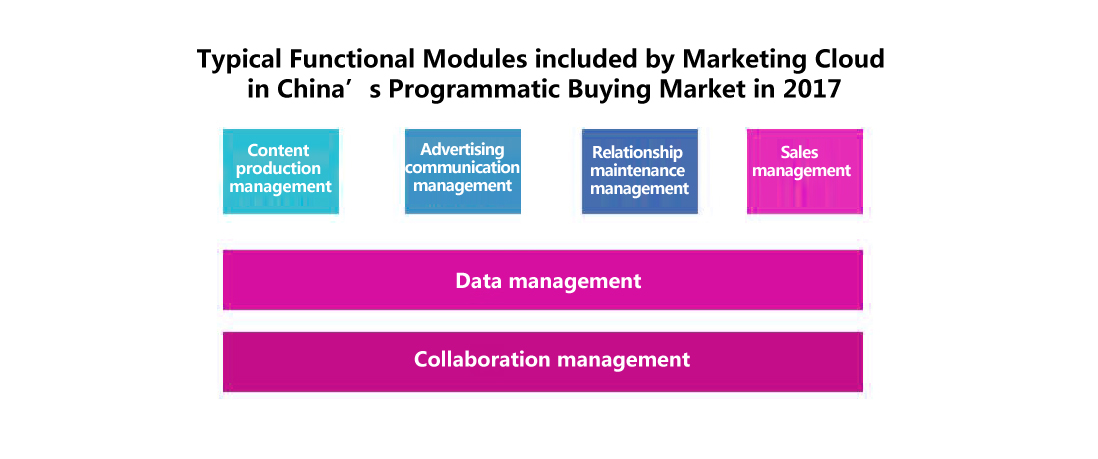

In the trend of continuous penetration of the Internet to the offline life, the contact between advertising and marketing, public relations and sales is increasingly close. Online advertising application technology migrates from the early Ad-Tech to Mar-Tech. The so-called Mar-Tech refers to the management, promotion and evaluation of marketing activities through IT technology, based on the Internet and the mobile Internet, which covering all the sectors of the marketing activities. Its essence is data driving marketing activities, depending on the artificial intelligence, large data and cloud computing supports at the bottom.

Mar-Tech's rapid development will promote the realization of marketing cloud, and marketing cloud should include six management modules: content production management, advertising communication management, relationship maintenance management, sales management, data management and collaboration management. At present, each management module has companies to provide the appropriate products and services, and the realization of the organic combination of these modules is an important direction for the future development of marketing cloud.

Trend 6: Intelligent marketing will come soon.

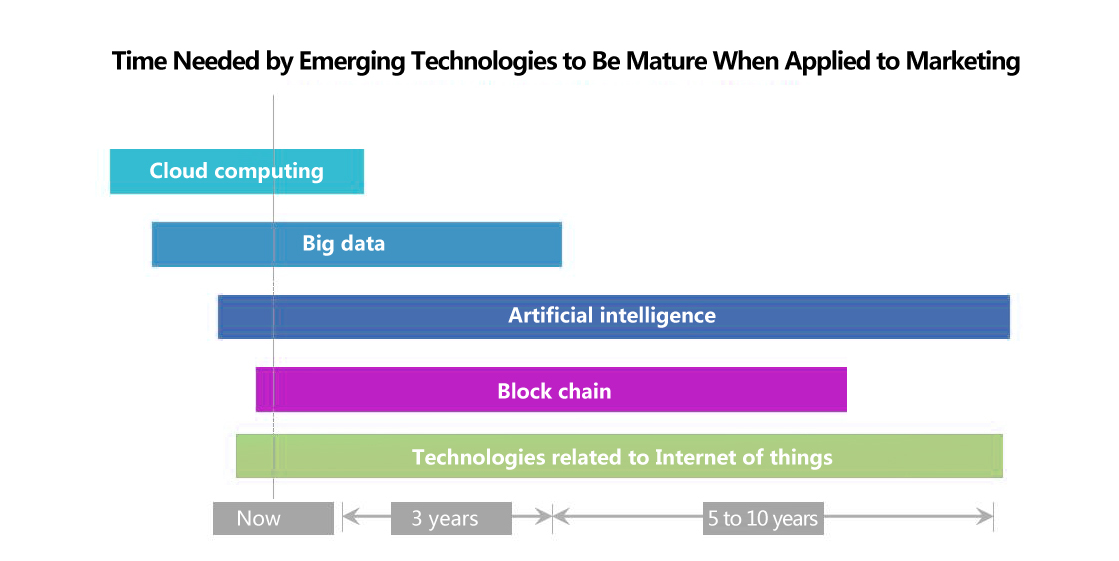

Most of the emerging technologies will be soon applied to marketing.

At present, the application of cloud computing and big data is very popular and artificial intelligence has also emerged, promoting the development of intelligent marketing. Block chain technology, sourcing from Fin-tech, has begun to solve the transparency and security issues in marketing. In the near future, with the maturity of technology related to Internet of things, in the environment of intelligent perception, marketing will be more ubiquitous accompanied by the changes in scenes. Marketing has never missed the application of every emerging technology and this time is no exception. IResearch believes that artificial intelligence, block chain and technologies related to Internet of things in the field of marketing need at least 5 to 10 years from application to maturity.

Read the『Important Legal Notices』for the relevant disclaimer.

The products and services on this website may not be available to users in certain countries.

Please check the sales restrictions related to the service in question for more information.

Copyright © 2012-2017 Standard Perpetual, ALL RIGHTS RESERVED.